Risk Decisioning

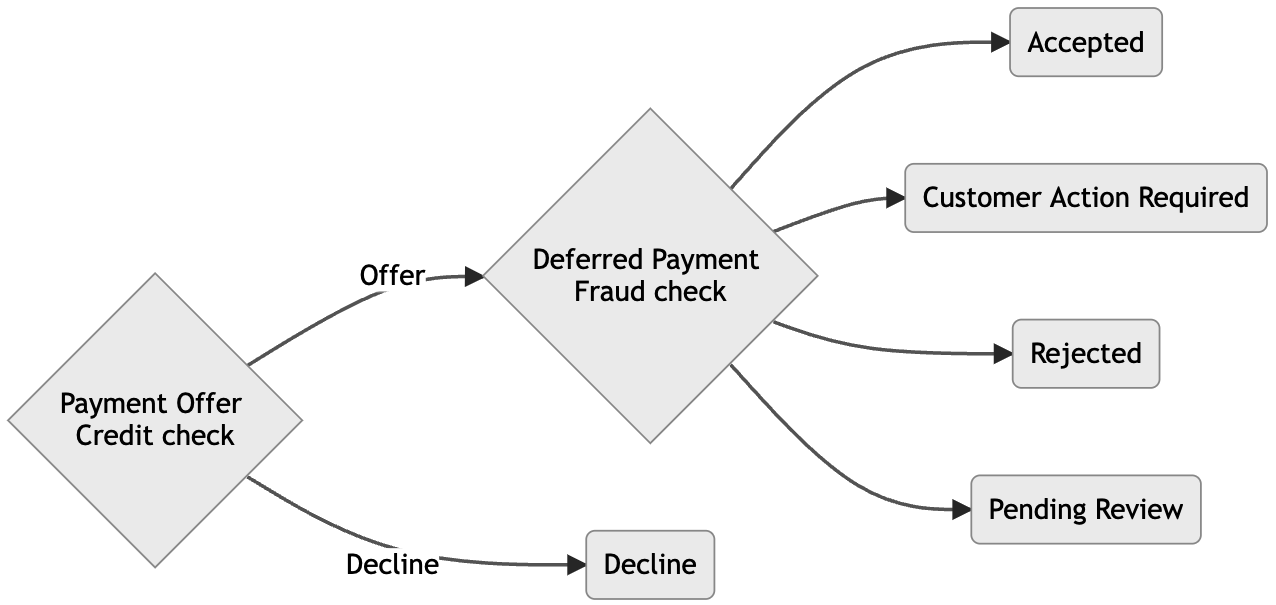

There are two main stages of our risk decisioning:

| Type | Evaluation | Customer Journey Stage | Can be overriden by Merchant Limits? |

|---|---|---|---|

| Credit Risk | Will this Customer be able to pay this invoice? | Payment Offer creation | ✅ |

| Fraud Risk | Is this Customer who they say they are, or are they acting suspiciously? | Deferred Payment creation | ❌ |

The statuses of objects as a result of this decisioning is shown in the below diagram.

Credit Risk decisioning

Credit risk decisioning is enabled by default for all our merchants.

Credit Actions

In the event that we're not able to give the required credit limits to buyers automatically, review the credit_actions field in the credit limits endpoint. This will advise on the most effective next steps to increase the buyer's limit.

If it is recommended to submit a Credit Limit Review, we'll advise on which documents should be submitted by the buyer or merchant in their respective portal.

The credit actions that we return are shown below.

| Credit action code | Meaning |

|---|---|

| no_action_possible | We don't believe there is any action that would enable us to cover this buyer. |

| email_buyer_support | Get in touch with support@hokodo.co and we will provide further information on next steps. |

| pay_overdue_deferred_payments | The buyer is being blocked by overdue invoices that need paying. |

| provide_bank_statements | Submit a Credit Review and supply bank statements. |

| provide_latest_financial_statements | Submit a Credit Review and supply financial statements. |

| submit_credit_review | Submit a Credit Review. Documentation is required if you also see credit actions provide_bank_statements and/or provide_latest_financial_statements. |

| await_credit_review_completion | A Credit Review is already underway and you should wait until it's completed. |

Note: these codes are subject to change without notice.

Unprotected Credit and Merchant Limits

You can exceed the credit limit set by our credit risk decisioning engine by setting a Merchant Limit. Hokodo will protect the portion of the order covered by our credit risk decisioning engine. The portion of the order above that is accepted at your own risk. The Merchant Limits are the mechanism for you to manage your exposure to that risk.

Outside of our core EU geographies (GB, FR, ES, DE, IT, NL, BE), the protected and unprotected credit lines are seperate. This means that an order needs to be either fully protected or fully unprotected. In our core geographies, the credit lines are blended so an order can be part protected and part unprotected.

Fraud Risk decisioning

This is enabled for most merchants, but some merchants choose to opt out. This can be configured by your Customer Success Manager.

Improving risk decisioning

Your historical buyer data can help Hokodo make more accurate risk decisions and reduce friction for your buyers at checkout. This may increase the credit offer rate and decrease the probability of a Deferred Payment going to the Pending Review in the fraud process.

This historical data can be shared as metadata:

- at order creation

- in the credit limits endpoint

The field should be submitted as a set of key-value pairs. We recommend the following fields to be shared; if you believe there are other data points that may support Hokodo’s risk assessment, you can share additional data. Please provide a description of the business logic to your Customer Success Manager.

| metadata field | type | description |

|---|---|---|

| subscriber | boolean | whether the buyer pays a monthly fee, eg. for any extra services |

| buyer_id | string | the unique identifier of the buyer on your platform |

| channel | string | the channel the buyer was acquired via (e.g. search engine, social media, referral, etc.) |

| checkouts_count | integer | the number of checkouts completed by the buyer to date, excluding Hokodo orders |

| checkouts_value | integer | the value of checkouts completed by the buyer to date, excluding Hokodo order |